There’s an ongoing debate in every industry over counter offers.

Should you turn them down or should you take them? And are you damaging your career if you stay?

Should you always believe what your recruitment consultant tells you?

Or sometimes are they simply saying what they NEED YOU to hear?

Does the looming potential of lost commission have an impact on the advice you get?

With all these questions circulating, it’s clear to see that many people are confused over what the right move actually is.

Why?

What makes it harder is sometimes you might not feel your recruitment is always honest by peddling these myths.

Here at Vertical Advantage, we see no advantage in pulling a wool over the eyes of our clients and job seekers.

We believe that the more transparent the process is, the happier and successful everyone is all round.

So, in order to give you a bit of clarity, we’ve deconstructed the 4 most common counter offer myths.

Myth #1 – Say yes and your manager will still think you’re disloyal

When a good employee resigns, an employer might try to get them to stay – not just because they’re valuable to the business, but because recruiting a replacement takes time and money and it’s easier to keep the person they have.

Your recruitment consultant might tell you that if you take the offer, your boss will (secretly or not so secretly) think you’re disloyal and that it will have a negative impact on working in the company.

This just isn’t always true.

Working for a company is a two-way street – if your boss offers you a counter offer it’s because they NEED you in the here and now and if they are going to be able to manage you, they’ll need to let go of any bad feeling.

Remember: They gave you the chance to stay and you took it – so there is no value in them harbouring any belief that you’re disloyal.

Myth #2 – Say yes and your internal reputation is damaged beyond repair

You might be thinking that if you take the counter offer your colleagues will turn against you. You might have had this fear confirmed by your recruitment consultant.

Think about it this way:

At some point in their career, most, if not everybody, in your team will have explored the job market.

Your colleagues may also have been given the chance to stay for a better package and experience.

Even if they didn’t take the counter offer, there’s a high chance they considered it.

So, they are likely to understand your position.

Moving jobs and progressing your career is par for the course – nobody stays forever and never looks around. Your colleagues know this too.

Myth #3 – Say yes and you’ll be first out the door if there’s a restructure

When it comes to a company restructure there will be a massive range of reasons behind any decision of who goes and who stays.

If you are proving your worth to the business, there’s no reason to think that because you once looked externally, you’d be pushed out if the time comes.

It’s important to view a restructure for what it is – a wider business decision – and not an opportunity for your boss to get revenge.

Myth #4 – Say yes and you’ll resign in a few months anyway

There are statistics that come up often which suggest that people who accept counter offers will resign not long after.

This can imply that accepting is pointless.

However, statistics are always open to interpretation.

Even if people end up resigning later, it doesn’t prove that it was wrong to stay.

A decision has to be made based on the scenario at that point in time and stats like this are purely a snapshot of a much wider, more complex decision.

Now the lies behind the counter offer myths have been exposed:

Should you stay or should you go?

No two situations are the same and sometimes accepting the counter offer could be the right move for you.

The resignation / counter offer scenario could be an opportunity for an honest conversation with your boss. The real positive is that if underlying issues are resolved it makes perfect sense to stay where you are.

But think what this says about the state of your relationship with your boss.

Should it really take handing in your notice to get their attention?

Rather than seeing this as a chance to start an open conversation, perhaps it’s really a sign that your relationship isn’t as strong as you thought it was and shows that moving on is the RIGHT step to take.

Also, are there any issues which a counter offer simply couldn’t fix?

Hard facts like a daily commute being too long just can’t be solved with a counter offer of more money or responsibility, so if points like this were bothering you, moving on stands out as the clear choice.

When it comes to counter offers, ideally, it’s better to avoid the situation in the first place.

The best way to make this happen is to address any frustrations you have BEFORE you find yourself itching for a new job.

Think in depth about your career – could you achieve your goals where you are or do you need to move?

Knowing what you want out of your career and your personal tipping point will help avoid the counter offer scenario before it even starts.

If you’re swinging more towards accepting a counter offer, here’s 3 influencers to consider

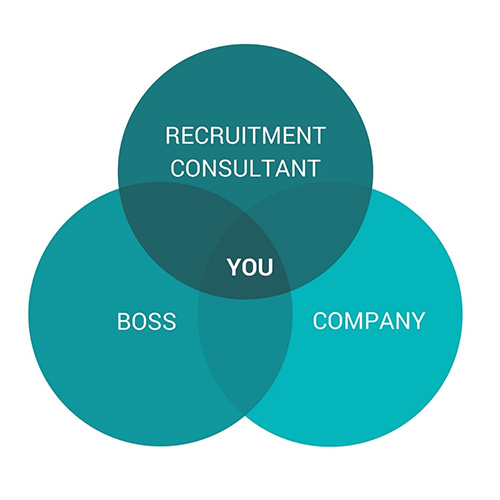

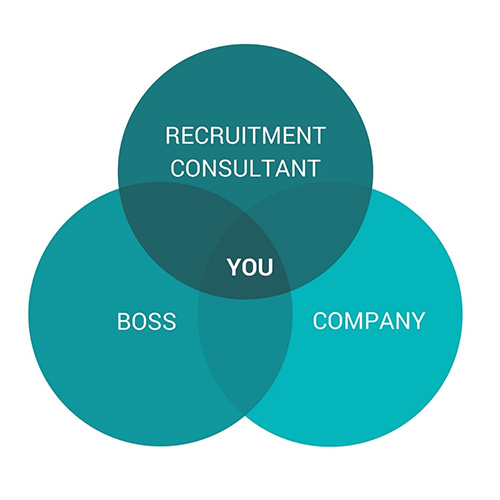

In a counter offer scenario, there are 3 very different factors at play.

The politics of your company will influence their actions – perhaps they made a counter offer because they can’t afford to recruit somebody new?

Your boss might want to counter offer because they don’t want the hassle of sourcing a new replacement.

Your recruitment consultant may be encouraging you to accept the new offer so they can fulfil their client brief.

So, where does this leave you?

If you’re in the middle.

With these influencing factors, it can be hard to fully evaluate the situation.

Only you are at the centre of any counter offer situation and only you can decide the best move for your career.

If you feel stuck, make the most of your recruitment consultant.

While they want to deliver for their client, good consultants also want to deliver for their candidate.

If your consultant is honest and transparent (and doesn’t feed on the myths mentioned they can provide insightful feedback which could help you see the bigger picture.

Recent Comments